Explanatory Note: The legal advice hereunder was given to a group of Developers who submitted an investment proposal in a gas-fired power plant in a Sub-Saharan African country. To maintain integrity, the author employed fictitious names for the host country, affiliates, and participants.

An excerpt from

LEGAL MEMO

Mbono Gas-Fired Power Plant

for Good Hope Energy & Co

1. Background

The Government of the Republic of Sous-Heldria in Sub-Sahara Africa invited prospective international investors to invest in electric-power generation for domestic supply. The investment envisages raising funds from various offshore financing sources and attracting international participants to partake in the project financing. The sponsors led by Good Hope Energy & Co, hereinafter collectively referred to as the (“Developer”), proposed terms to finance, build, construct, and operate a power plant to generate electricity to meet the demand in the Capital City. The Developer engaged Phomsoupha & Son Law (“P&SON), an international law firm familiar with the host country’s civil law system, to conduct legal research concerning contract formation for financing the gas-fired power plant. Upon completing its preliminary legal analysis, P&SON composed a legal memo to address the Developer’s concerns over the host country changing applicable laws regarding environmental requirements and increasing the tax rates on gas after the project company has completed the construction and installation of the facilities.

2. Definitions

Unless otherwise expressly provided in this Memo, when used hereunder, each of the following terms shall have the meaning specified below:

“P&SON” means Phomsoupha & Son Law, the international law firm domiciled in Lao PDR employed by the Developer to conduct legal research in respect of legal consideration for the Project development;

“CA” means the Concession Agreement, which the Government of the Republic of Sous-Heldria will sign with the Project Company;

“Company” means MBono Power Company Limited or the Project Company, which the Sponsors or Shareholders will establish to finance, construct, own, and operate the Project facility according to the Laws of ROS;

“Developer” means a group of sponsors led by Good Hope Energy & Co, whom the GOS invited to seek opportunities to invest in the MBono Gas-Fired Power Plant;

“EDS” means Electricité de Sous-Heldria, the public utilities organized and existing under the laws of the ROS, dealing in electricity generation and dispatch to the designated load demand centres in the country;

“GDS” means Gaz de Sous-Heldria, the state-owned enterprise organized and existing under the laws of the ROS;

“GOS” means the Government of the Republic of Sous-Heldria, including the lawful legislative, executive and administrative bodies subordinating its ministries, departments, government agencies, municipalities, local or statutory authorities or state-owned enterprises;

“Laws of the ROS” or “Laws” means the constitution, international treaties and conventions, all national, provincial, and local laws, decrees, rules, regulations, orders, codes directives, legally binding actions and enactments of the ROS as from time to time in force and effect in the ROS;

“PPA” means the Power Purchase Agreement entered into between the Company and Electricé de Sous-Heldria;

“Project” means MBono Gas-Fired Power Plant, with an installed capacity of 350 megawatts, located near the Capital, more explicitly given in Section 3 hereunder;

“ROS” means the Republic of Sous-Heldria, a sovereign state in Sub-Saharan Africa.

3. Project Description

The MBono Gas-Fired Power Plant Project, with an installed capacity of 350 megawatts, is about 30 kilometres to the West of the Capital. Work on the technical feasibility and environmental and social impact assessment is underway. The Project Company will invest in the Project on a limited recourse financing basis in a Build-Own-Operate mode. After signing the CA, the Company will sign a 15-year Gas Supply Contract, after which GDS will construct and own the 4-kilometre gas pipeline stretching from the gas purification facilities to the power plant. Upon signing the PPA with EDS, the Company is committed to supplying electricity generated by the Project to EDS, which will construct, own, and operate the 30-kilometre-long double-circuit 230-kilovolt transmission line cum switching yard as part of the project facilities from its powerhouse to a 230/115kV substation. The Company’s shareholders will inject 30% of the total project cost as equity, while international commercial banks will loan the rest. It is unlikely that the host government will provide any financial guarantee in favour of the Company and its financing parties, to which they can resort upon financially adverse events. Thus, the funding for the Project mainly depends upon the commercial arrangement between the borrowing Company and lending banks.

4. Material Project Agreements

4.1. Preparatory Work

Inherent studies, including the feasibility, environmental and social aspects, are legally required by Laws for a low carbon-emission establishment like the gas-fired power plant. To address the concern over environmental issues, the Developer needs to engage reputable field advisers to conduct a technical feasibility study (“FS”) and environmental and social impact assessment (“ESIA”) for the Project to convince the host country of the level of impacts compared with benefits for the society. On the preceding basis, the ESIA will have to determine an appropriate number of pollution control equipment to have known to the Sponsors and financing parties from the outset. At law, once a responsible governmental agency has endorsed study results by issuing an Environment Compliance Certificate (“ECC”), the Government and its agencies are bound by such a certificate. Otherwise, the GOS will be in breach if it or any of its agencies subsequently requires the Company to do things beyond what was officially endorsed earlier.

4.2. Contractual Arrangement

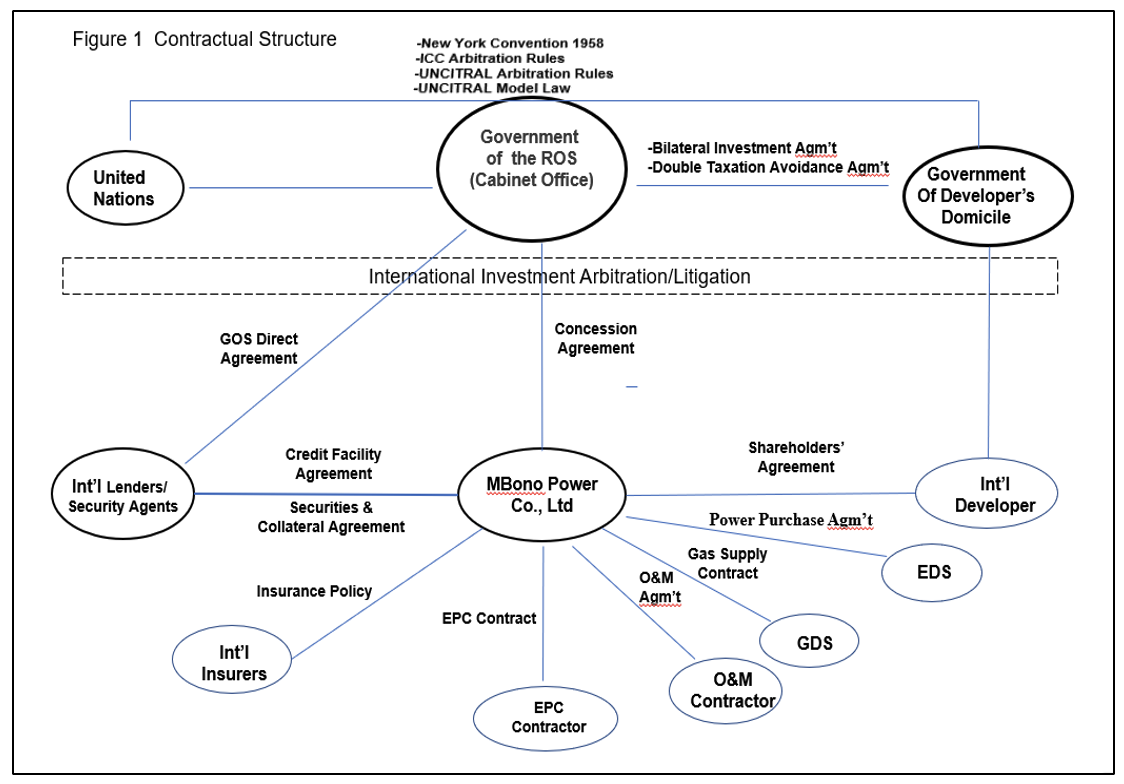

In practice, project finance in a long-term project involves several agreements independently interwoven in the deals. The selected agreements below help the Developer or Company address change-in-law events that can adversely affect its respective interests. After obtaining certificates of the FS and ESIA from relevant GOS agencies, the Developer will sign the Shareholders’ Agreement to form a company under the Laws of the ROS. As the legal entity, the Company will be pivotal in signing the CA with the ROS. Next, the Company will enter into the Loan Agreement complemented by a security agreement with lenders, an insurance policy with international insurers, the Gas Supply Contract with GDS, a PPA with EDS, the EPC Contract with an EPC contractor, and an Operation and Maintenance (“O&M”) with an operator. Figure 1 below presents the Developer with a conceptual framework of a contractual structure for project finance.

5. Core Agreements

5.1. Concession Agreement

As the masterpiece of the entire GOS permits pertinent to the development and finance of the Project, the CA must contain intrinsic clauses. However, P&SON presents the selective clauses below to aim at answering two questions on subsequent changes to environmental requirements and tax position as may be triggered by the GOS below:

– The Concession Agreement (the “Agreement”) will be signed by and between the Government of the Republic of Sous-Heldria, represented by the Cabinet Office Chief and MBono Power Company Limited, represented by the Chief Executive Officer;

– Keywords used in the CA and annexes must be established. With the emphasis on the Developer’s interest, each of the change-in-law, Political Force Majeure events, and sovereign acts that can trigger changes to the GOS tax policy and environment requirements must be clearly defined;

– The CA shall be effective upon the responsible GOS agency issuing the ECC and conditions precedent;

– Concession Period. The term must include construction followed by the operation period spanning 15 (fifteen) years, coterminous with the terms of the PPA and Gas Supply Contract, from the commercial operation date of the power plant till the 15th anniversary thereof unless earlier terminated or extended by the parties;

– The GOS shall grant the right to the Company to finance, construct, own, and operate the Project facilities coterminous with the concession period;

– Each of the GOS and Company will have their respective responsibilities to remedy their defaulting acts that adversely impact the others;

– GOS Taxes. The CA shall fix rates of royalties and taxes as required under the Laws of the ROS in the CA, altering which by the GOS shall trigger a change-in-law event;

– Events of Default. The events and remedial actions shall be exhaustively listed in the CA;

– Force Majeure. Natural, non-natural events and change-in-law occurrences shall be elaborated on;

– Upon the occurrence of each event of default, Force Majeure, and change-in-law, the party having the most appropriate capacity shall be obligated to remedy the adverse event;

– Dispute Resolution. The CA shall set up mechanisms, for instance, amicable solutions, consultation, and arbitration, to redress differences that may arise during the contract performance. As the CA is an internationalized undertaking, dispute resolution shall be instituted in a neutral venue;

– Representation and Warranty. The Company shall insist on the GOS making representations and warranties that the Government and its agencies will neither impose environmental conditions other than those already endorsed in the Environment Compliance Certificate nor increase tax rates already agreed upon under the CA;

– Governing Law. The CA will be governed by, construed, and interpreted in accordance with the Laws of the ROS. If the Laws are found to be wholly silent on or inadequate for any issue in question, then solely to the extent of such silence or inadequacy, as the case may be, for the purposes of the interpretation thereof, English law shall apply, as to be in line with the loan arrangement;

– Waiver of sovereign immunity. The Company should insist on the GOS expressly, separately, irrevocably and unconditionally waiving its rights to immunity for itself and its properties and assets regarding its obligations arising under the CA.

5.2. Loan Agreement

In borrowing 70% of the total Project, the Company will sign a loan agreement with a group of creditors known as the syndicating banks. The Company will place the concession rights, intangible assets and physical property as the securities for loans granted by commercial lending banks. As advised, the Loan Agreement will be governed by English law. The provisions in respect of definitions and consequences of Force Majeure and change to statutes under the CA shall be cross-relied on those under the Loan Agreement so that a GOS breach under one agreement would result adversely in the other. At law, lenders require the host agency to enter into a direct agreement with them so that they can enforce securities in the borrower’s location upon a borrower event of default as may be triggered by the GOS’ action. Hence, the direct agreement is one of the agreements into which the change-in-law clauses will be inserted.

5.3. Gas Supply Contract

The Company will sign a contract with GDS, whereby the Company agrees to buy, and GDS accepts to supply gas to the Project on agreed terms. The Laws of the GOS will govern the Gas Supply Contract. The Company must insist on inserting the representations, warranties, and cross-default provisions under the CA into this agreement.

5.4. Power Purchase Agreement

The Company will sign the PPA with EDS to the domestic electricity supply. The electricity supply shall be at least ninety (90) per cent of the plant’s availability. EDS shall be committed to buying electricity sold by the Company on a take-or-pay basis. The electricity tariffs shall be fixed and indexed to the gas price over the 15 years coterminous with the term of the CA. The PPA will be governed by and interpreted in accordance with the Laws of the GOS. Where EDS is defined as a GOS agency, the Company must also propose to EDS to incorporate the representations and warranties provisions and cross-default provisions into the PPA to cross-refer obligations of the parties to the CA.

6. Recommendations

(i) These days, governments worldwide have granted rights to private entities to raise capital from private institutions for financing various infrastructure-like projects to deliver commercial goods and services. Limited recourse financing applies to long-term projects ranging from electric power generation to telecommunications to tollways and urban water supply. In mobilizing investment funds for a project, sponsors, acting as the borrower, provide securities over the project assets for borrowing capital from lending banks. Assurances from the host country are crucial for all participants to sustain project finance in a risk-prone environment.

(ii) Several fields, including electricity, environment, finance, law, and public-private interaction, are typically involved in one project. International parties’ confidence in the host government is a decisive factor for the private parties to bring funds into the country. Thus, the Developer takes the right approach to engage the international legal adviser to assess the degree of imminent threats before approaching the lenders. To this end, one should note that political and commercial risks vary from jurisdiction to jurisdiction.

(iii) The ECC, when issued, shall restrain the GOS and its agents from demanding things exceeding previous approval, although the local civil law is silent on the estoppel doctrine. P&SON advises the Developer to insist on incorporating GOS’ commitments concerning consistent tax policy and environmental requirements in several legal documents. Any GOS act triggering change to its tax position impacting the Company’s economic position shall be addressed in agreements to which the GOS is the party. In the event that the foregoing event occurs to the extent of causing harm to the Project, the Developer or Company insists on the GOS being the best-suited party to rectify them in due cause. Thus, the Developer should assert its proposition on the preceding clauses in other core Project agreements.

(iv) Additionally, the Company should humbly ask the GOS, to the extent possible, to take political or partial risk insurance against adverse events caused by sovereign acts, such as change-in-law, that can cripple the operation of the Project. The insurance coverage helps address the concerns of the financing parties and other participants partaking in the financing of the Project. The combination of insurance and safeguard provisions shall relieve the Company from the risks to a great extent.

(v) Finally, given its legal feasibility, P&SON assures the Company that the MBono Gas-Fired Power Project is promising. The Developer should take further steps to countenance finance, construction, and operation of the Project in a timely manner. Although the risks are unpredictable, proactive acts to mitigate risks by incorporating change-in-law provisions into the core agreements can protect the Company from financial detriment to a great extent. The legal advising shall help the Developer to balance risks and rewards.